Why did the job market cool considerably in 2025?

The latest Bureau of Labor Statistics report shows the U.S. job market cooled notably in 2025, with slower hiring, rising unemployment, and several months of job losses—the first since 2020. Even so, it’s important to maintain perspective, as other parts of the economy continue to show resilience. Key points: – Hiring slowed sharply: 2025 saw […]

How does Venezuela affect portfolios?

You’ve likely seen recent headlines about the arrest of Venezuelan President Nicolás Maduro by U.S. forces. While the geopolitical implications are significant, many investors are understandably asking what—if anything—this means for financial markets. History suggests that geopolitical shocks often create short-term volatility, but they rarely change the long-term direction of markets. As shown in the […]

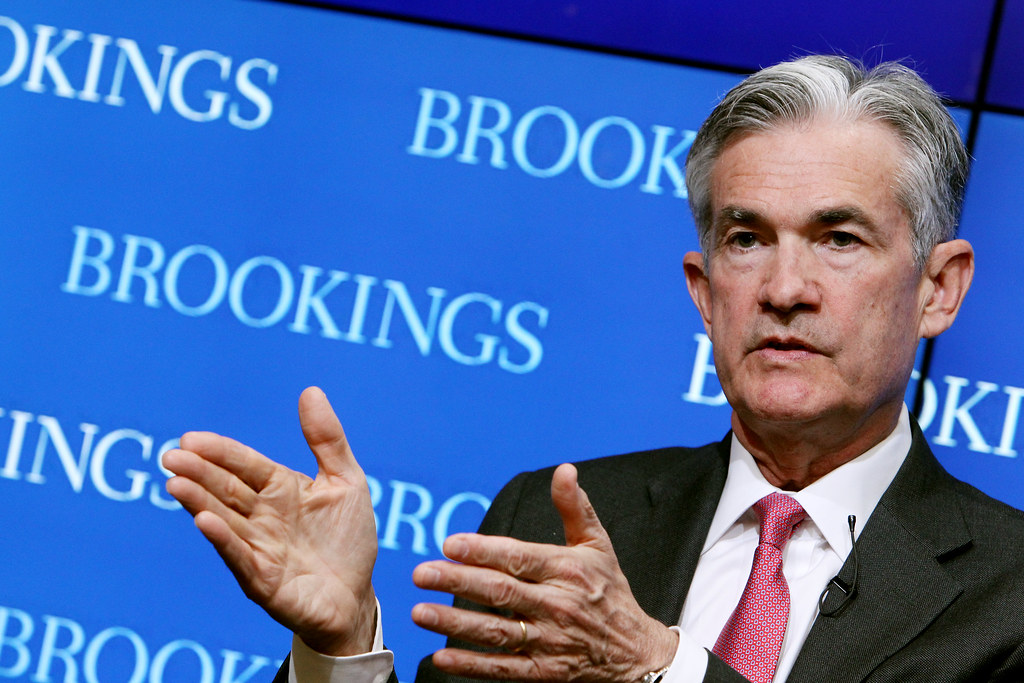

Why did the Fed cut rates at its December meeting?

At its December 2025 meeting, the Federal Reserve cut its benchmark rate by 0.25% to a range of 3.5%–3.75%, reflecting the difficult balance between easing inflation and supporting a softening labor market. Inflation remains above the Fed’s 2% target, while the unemployment rate has risen to 4.4% from 4.1% earlier in the year. Chair Jerome […]

3 Tax Planning Opportunities Before December 31

As 2025 comes to an end, investors face several time-sensitive decisions that can affect both taxes and long-term wealth. While planning should happen year-round, many tax-related deadlines fall on December 31, making year-end an important time to review strategy. Three areas in particular may warrant attention: Required Minimum Distributions (RMDs), Roth conversions, and tax-loss harvesting. […]

How does the new jobs report affect the economic outlook?

• The September jobs report was delayed more than six weeks due to the government shutdown. The October report will not be released because surveys were incomplete, adding uncertainty for investors and economists. Some October data will instead be published in December. • September payrolls rose 119,000, beating expectations of 51,000 and improving sharply from […]

Is there an AI Bubble?

With artificial intelligence dominating headlines and driving the stock market to new highs, many investors are asking whether we’re in another bubble like the dot-com era. It’s a fair concern given today’s high valuations and massive AI-related spending. Major companies are investing trillions in AI infrastructure—building data centers, purchasing GPUs, and hiring talent. Some deals […]

Understanding valuation metrics, like price-to-earnings ratios, helps investors gauge what they’re paying for company earnings.

Historical Stock Market Valuations The S&P 500’s forward P/E is 22.4x (vs. 15.9x long-term average), above normal but below the tech bubble peak of 24.5x. The Shiller P/E of 38x also exceeds its historical average of 27x, pointing to elevated valuations. Large Cap Growth stocks trade at the highest P/E (28x) with 16.1% expected earnings […]

The Great Wealth Transfer: Key points to consider.

What is The Great Wealth Transfer? The Great Wealth Transfer refers to the expected shift of $84 trillion from the Silent Generation and Baby Boomers to younger generations over the next two decades, marking one of the largest wealth shifts in modern history. Key points to consider: Scale and complexity: Baby Boomers hold over $82 […]

Understanding the Fed’s Rate Cut Cycles

Understanding the Fed’s actions is essential for financial planning, as interest rates influence mortgages, bonds, and economic growth.

How the “One Big Beautiful Bill” will affect both your personal finances and your business.

The government just passed the “One Big Beautiful Bill”, and it’s packed with changes that will affect both your personal finances and your business. We’ve distilled the key takeaways into clear, actionable insights so you can stay ahead.