As 2025 comes to an end, investors face several time-sensitive decisions that can affect both taxes and long-term wealth. While planning should happen year-round, many tax-related deadlines fall on December 31, making year-end an important time to review strategy. Three areas in particular may warrant attention: Required Minimum Distributions (RMDs), Roth conversions, and tax-loss harvesting.

- Required Minimum Distributions

Investors age 73+ (increasing to 75 in 2033) must withdraw RMDs from tax-deferred accounts such as IRAs and 401(k)s by December 31 to avoid steep IRS penalties. Withdrawal amounts depend on the previous year-end account balance and life-expectancy tables. Planning considerations include:

– Choosing which accounts to draw from and how withdrawals interact with Social Security taxes.

– The option to delay the first RMD until April 1 of the following year (which may result in two RMDs in one year and higher taxes).

– Alternatives like Qualified Charitable Distributions, which satisfy RMDs without increasing taxable income. - Roth Conversions

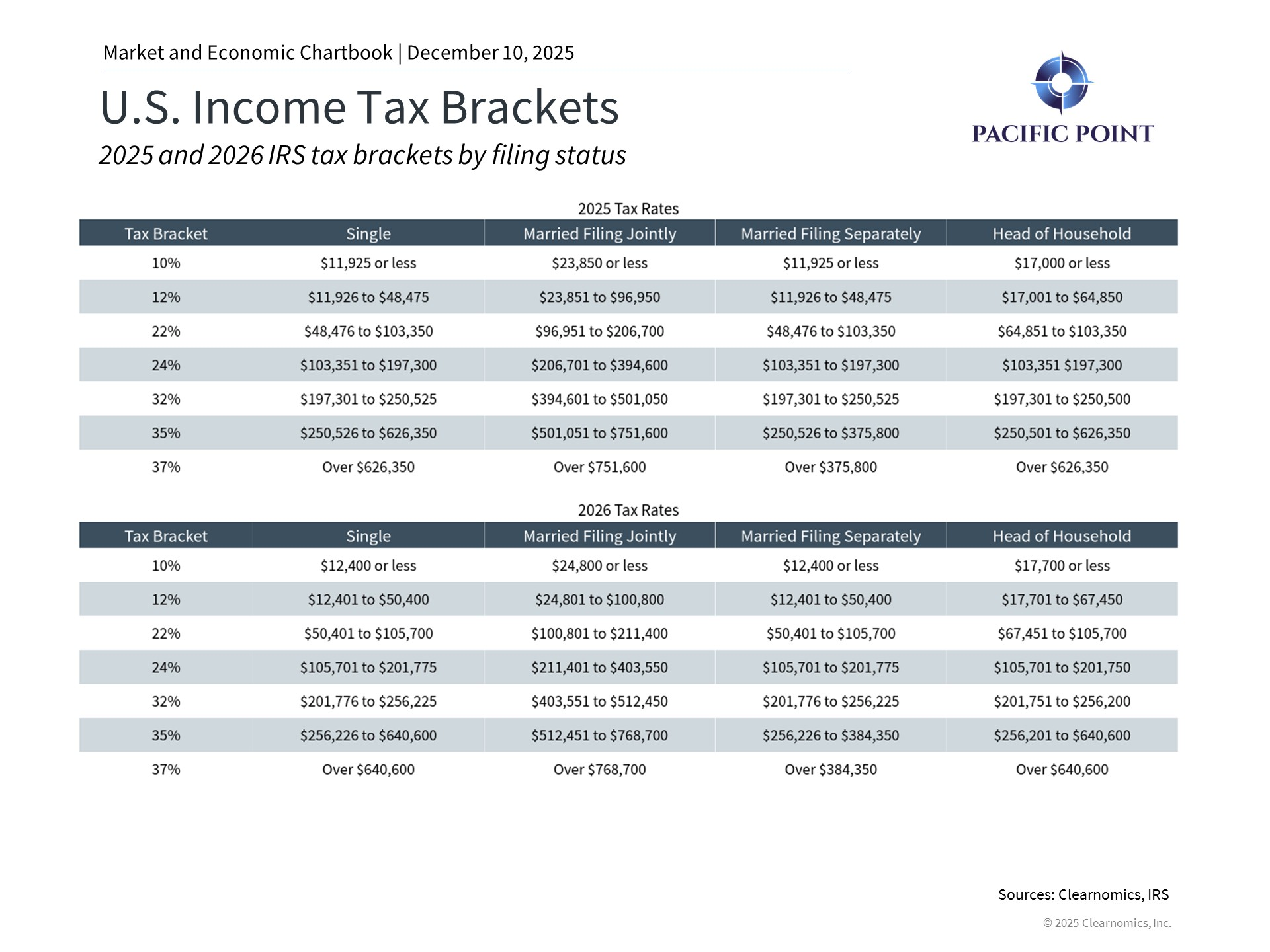

Roth conversions must also be completed by December 31. They involve moving funds from a traditional IRA to a Roth IRA and paying taxes now in exchange for future tax-free growth and withdrawals. Conversions may be attractive given today’s tax environment, especially for those who expect higher brackets later. Key factors include:

– Current vs. future expected tax rates.

– Time horizon for tax-free compounding.

– Potential impacts on Medicare premiums (IRMAA). - Tax-Loss Harvesting

For taxable accounts, tax-loss harvesting allows investors to realize losses to offset realized gains or reduce taxable income (up to $3,000 annually, with unused amounts carried forward). Important considerations:

– Offsetting short-term gains is often most valuable due to higher tax rates.

– The wash-sale rule prohibits repurchasing the same (or substantially identical) security within 30 days.

– This strategy applies only to taxable brokerage accounts, not retirement accounts.

Effective year-end planning is about coordination, not just individual tactics. While reducing this year’s tax bill matters, thoughtful planning should align near-term decisions with long-term financial goals.