Introduction

Following Fed Chair Jerome Powell’s remarks at the Jackson Hole conference, financial markets have largely embraced the prospect of September rate cuts. Powell highlighted the need to balance inflation concerns, including potential tariff impacts, with employment support. With markets trading near record levels, investor sentiment appears aligned with the Fed’s policy direction and economic outlook. For long-term investors, understanding what rate cuts could mean in this environment is essential.

Market confidence reflects Fed credibility

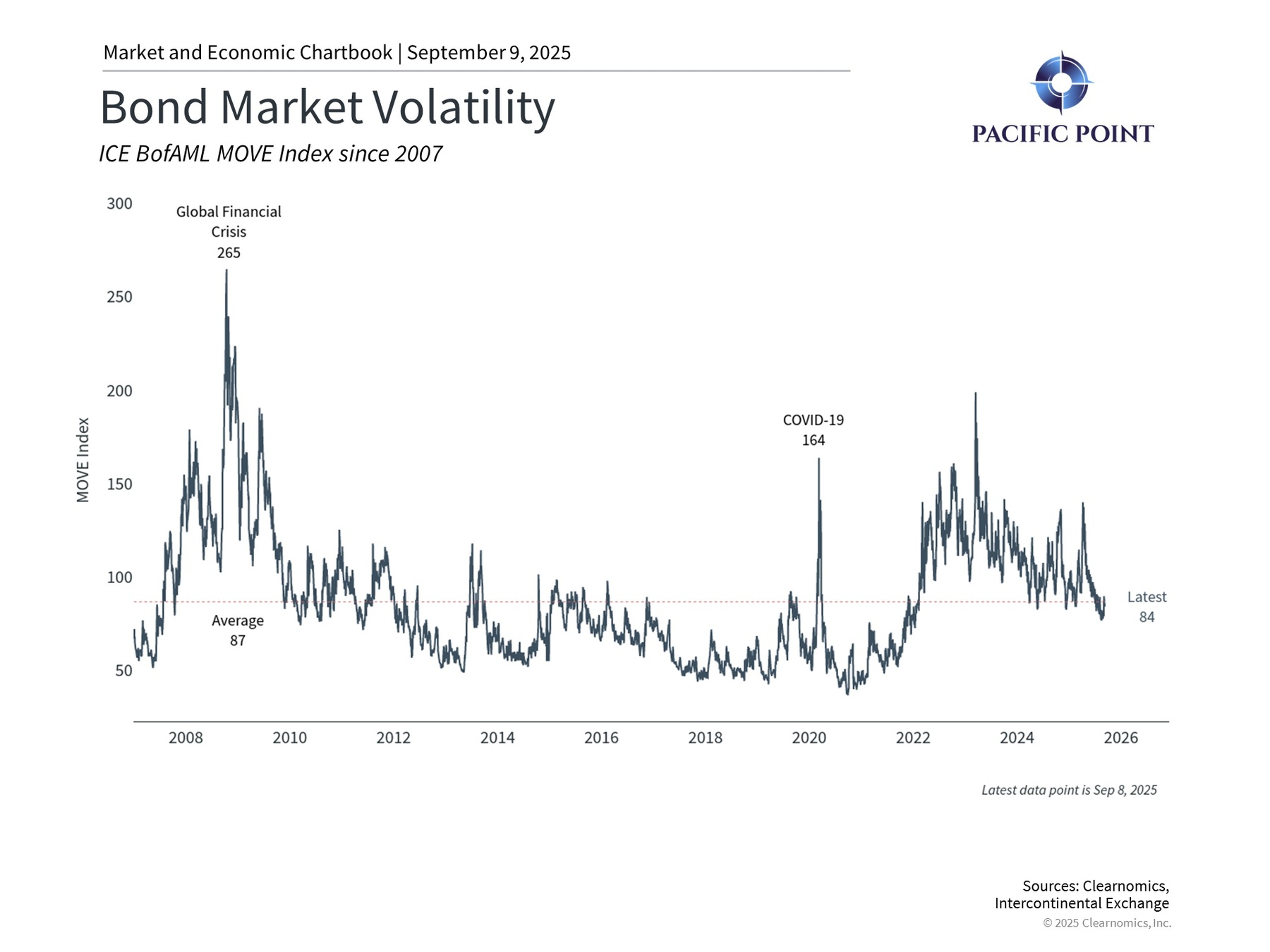

The bond market’s response to Fed policy reveals crucial insights about central bank credibility. While the Fed controls short-term rates, longer-term rates affecting mortgages and corporate lending are market-determined. This dynamic means Fed effectiveness depends heavily on investor confidence in the central bank’s ability to meet its objectives.

Historical examples illustrate this relationship clearly. During the 1970s, Fed credibility suffered as inflation surged, prompting bond investors to demand higher yields despite official policy. Conversely, post-2008 Fed credibility helped anchor long-term inflation expectations even during challenging periods.

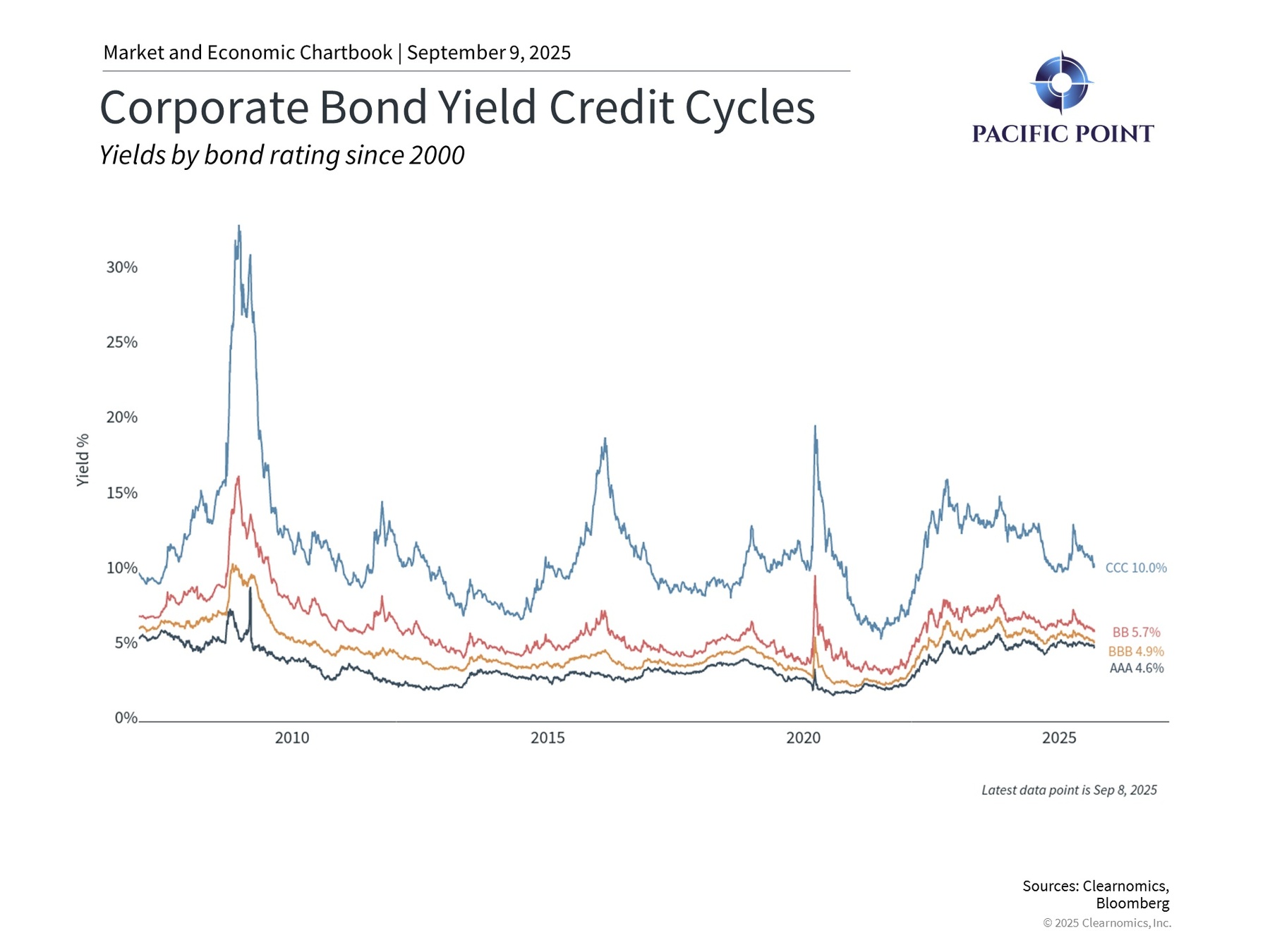

Corporate bond markets provide a clear gauge of this confidence today. Credit yields and spreads have reached multi-year lows, as the accompanying chart demonstrates. High-yield spreads have similarly compressed, reflecting investor comfort with corporate credit risk. These conditions align with equity markets achieving new highs, reinforcing the confidence theme.

Fed positioning for cautious cuts

Powell’s Jackson Hole address emphasized the Fed’s dual mandate challenges. While acknowledging upside inflation risks from tariffs, he stressed “significant risks to employment to the downside.” Recent data supports this balanced concern, with core PCE at 2.8% above the Fed’s 2% target, yet July adding only 73,000 jobs versus historical averages.

The Fed faces uncertainty about whether tariff-driven price increases represent temporary adjustments or persistent inflationary pressure. Current positioning suggests measured rate reductions ahead, reflecting this cautious approach to balancing competing economic forces.

Rate cuts present broad investment opportunities

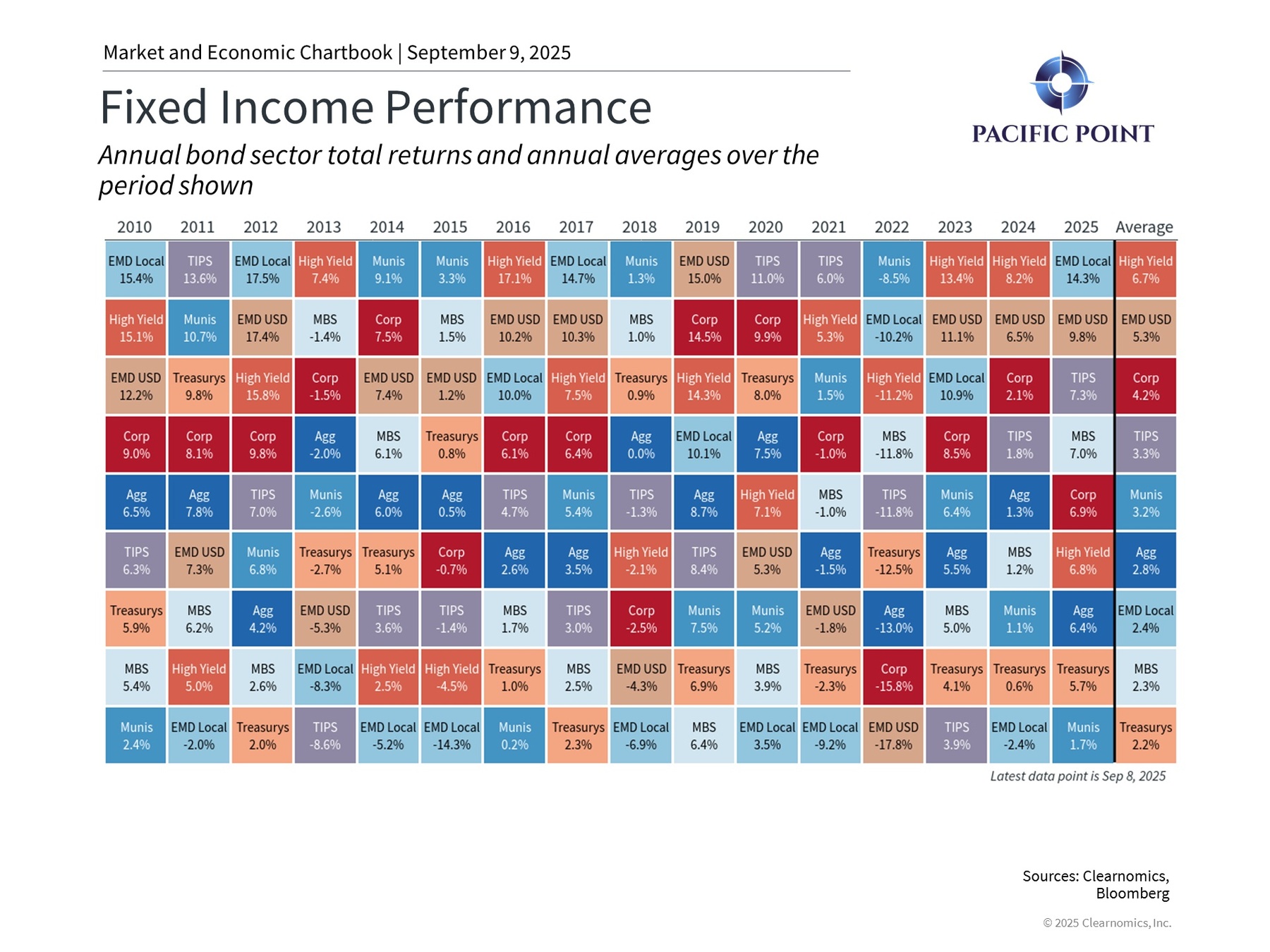

Expected rate cuts carry significant implications across asset classes. Bond markets typically benefit as existing higher-yielding securities gain value when rates decline. Current yields remain attractive at 4.0% for Treasurys, 4.9% for investment grade corporates, and 6.9% for high yield debt – all well above post-2008 averages.

For equity investors, lower borrowing costs can boost corporate growth while making future cash flows more valuable today. Recent market highs suggest investors are already positioning for this supportive backdrop.

However, compressed credit spreads and elevated valuations warrant disciplined approaches. When spreads are tight, corporate bonds may offer limited upside and face downside risks if conditions change. Similarly, high valuations could constrain long-term return expectations.

The bottom line? Strong market confidence in Fed policy direction and solid corporate fundamentals create opportunities for long-term investors. Maintaining appropriate portfolio allocation remains the optimal approach for managing long-term risks and returns.

Clearnomics Disclaimer

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.