Introduction

Investors constantly face the challenge of staying focused on long-term objectives while markets experience dramatic swings. Whether assets are surging or declining, daily headlines and market volatility can create pressure to make hasty decisions or succumb to fear of missing out.

Historical market cycles have taught seasoned investors that sustainable wealth building requires discipline and diversification. While alternative assets like cryptocurrencies and commodities capture attention during rallies, traditional stocks and bonds remain portfolio cornerstones for achieving balanced risk-return profiles.

With Bitcoin hitting record highs, copper prices soaring, and precious metals gaining momentum, investors must evaluate these assets within a comprehensive portfolio framework rather than as isolated opportunities.

Cryptocurrency volatility demands careful consideration

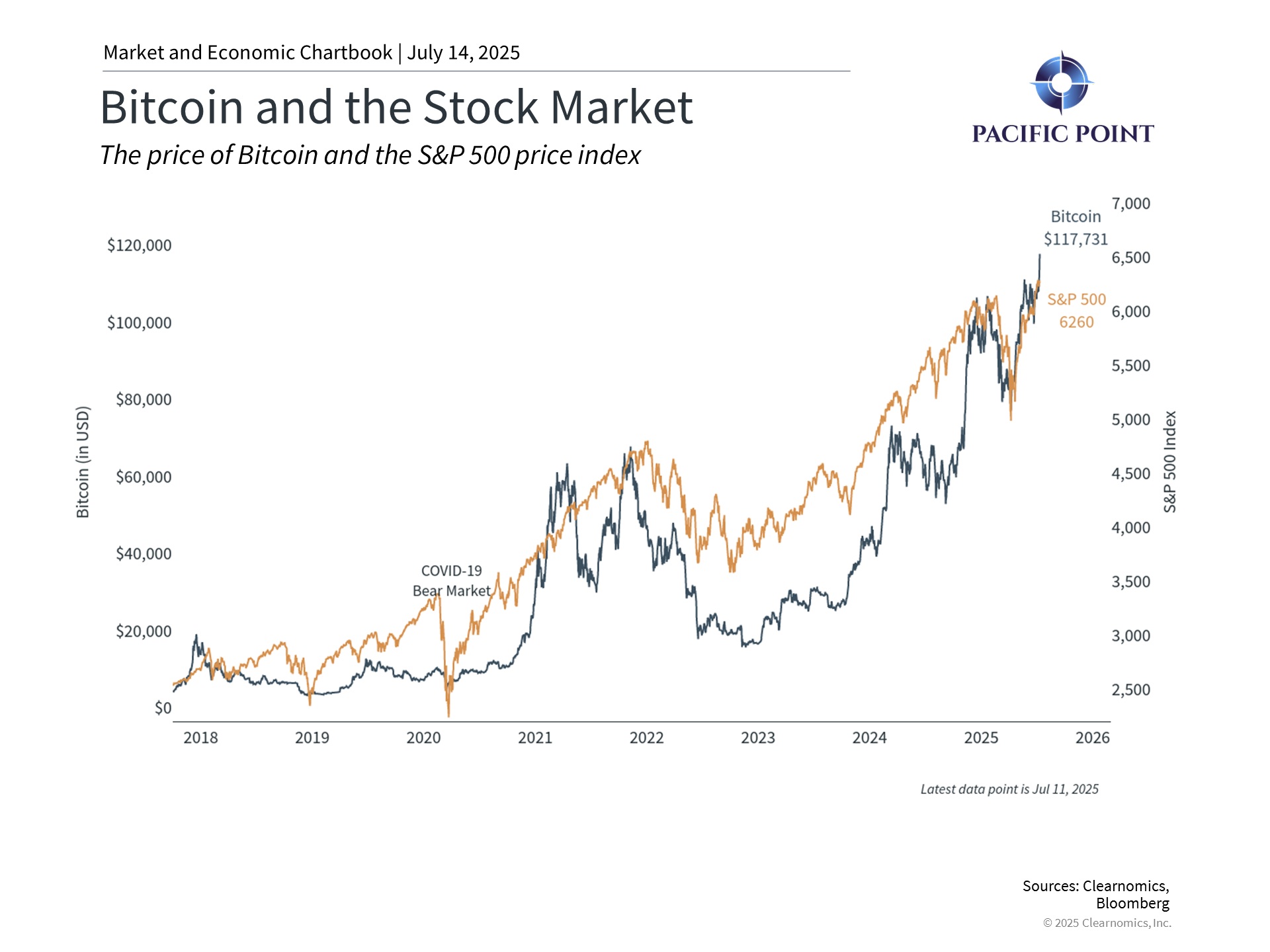

Bitcoin has reached new peaks amid congressional consideration of cryptocurrency legislation during “Crypto Week.” Proposed measures include the GENIUS Act for stablecoin regulation, the CLARITY Act for clearer digital asset frameworks, and the Anti-CBDC Surveillance State Act preventing Federal Reserve digital currency creation.

While institutional adoption and ETF availability have increased Bitcoin’s mainstream appeal, its extreme volatility remains a primary concern. During 2022’s market downturn, Bitcoin plummeted over 75% compared to the S&P 500’s 25% decline, highlighting how cryptocurrencies can magnify portfolio risk during stress periods.

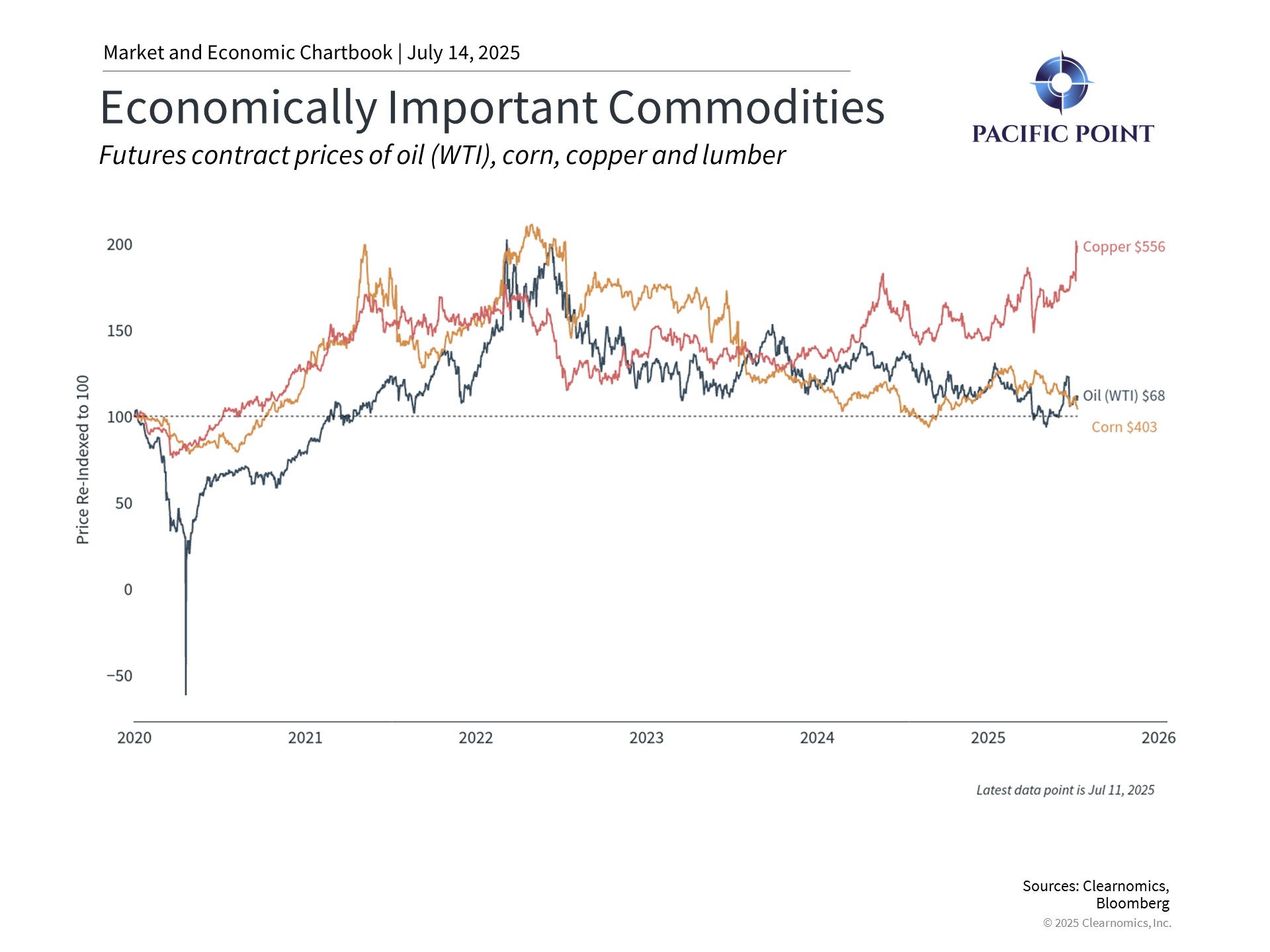

Industrial metals reflect economic and policy dynamics

Copper prices have surged to record levels following the White House’s announcement of 50% tariffs on copper imports. As an essential industrial metal for construction, electrical systems, and renewable energy infrastructure, copper serves as an economic barometer often called “Dr. Copper.”

Given that the United States imports 45% of its copper consumption from Chile, Canada, Mexico, and Peru, tariff policies will significantly impact pricing and supply chains. Rather than attempting to predict copper’s trajectory, investors should evaluate whether industrial metals enhance their portfolio’s overall characteristics alongside other economically-sensitive assets.

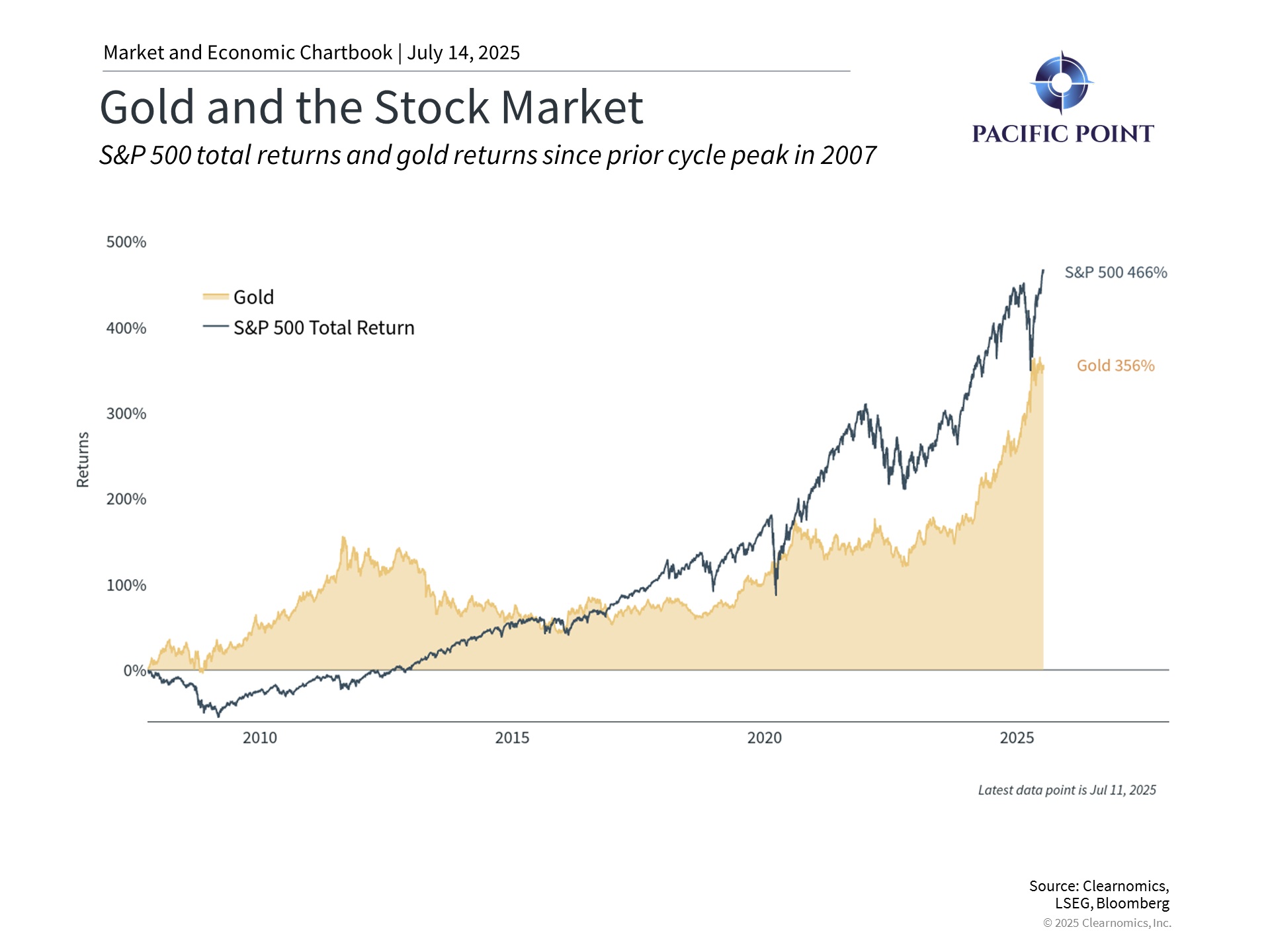

Gold and silver present mixed historical performance

Precious metals have gained traction as potential hedges against currency fluctuations, inflation, and geopolitical uncertainty. While gold provided protection during the global financial crisis, stock markets have generally outperformed precious metals over extended periods, even after recent rallies.

The 2010s demonstrated how unpredictable gold can be, as many expected continued gains during the Fed’s low-interest-rate environment, which failed to materialize. This reinforces the importance of focusing on overall portfolio alignment with long-term financial objectives rather than chasing individual asset performance.

The bottom line? Recent rallies in alternative assets shouldn’t drive investment decisions based on short-term performance. Understanding each asset’s unique characteristics and role within a diversified portfolio remains the most effective approach to achieving long-term financial success.

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has

been obtained from sources believed to be reliable, but is not necessarily complete and its

accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.