You’ve likely seen recent headlines about the arrest of Venezuelan President Nicolás Maduro by U.S. forces. While the geopolitical implications are significant, many investors are understandably asking what—if anything—this means for financial markets.

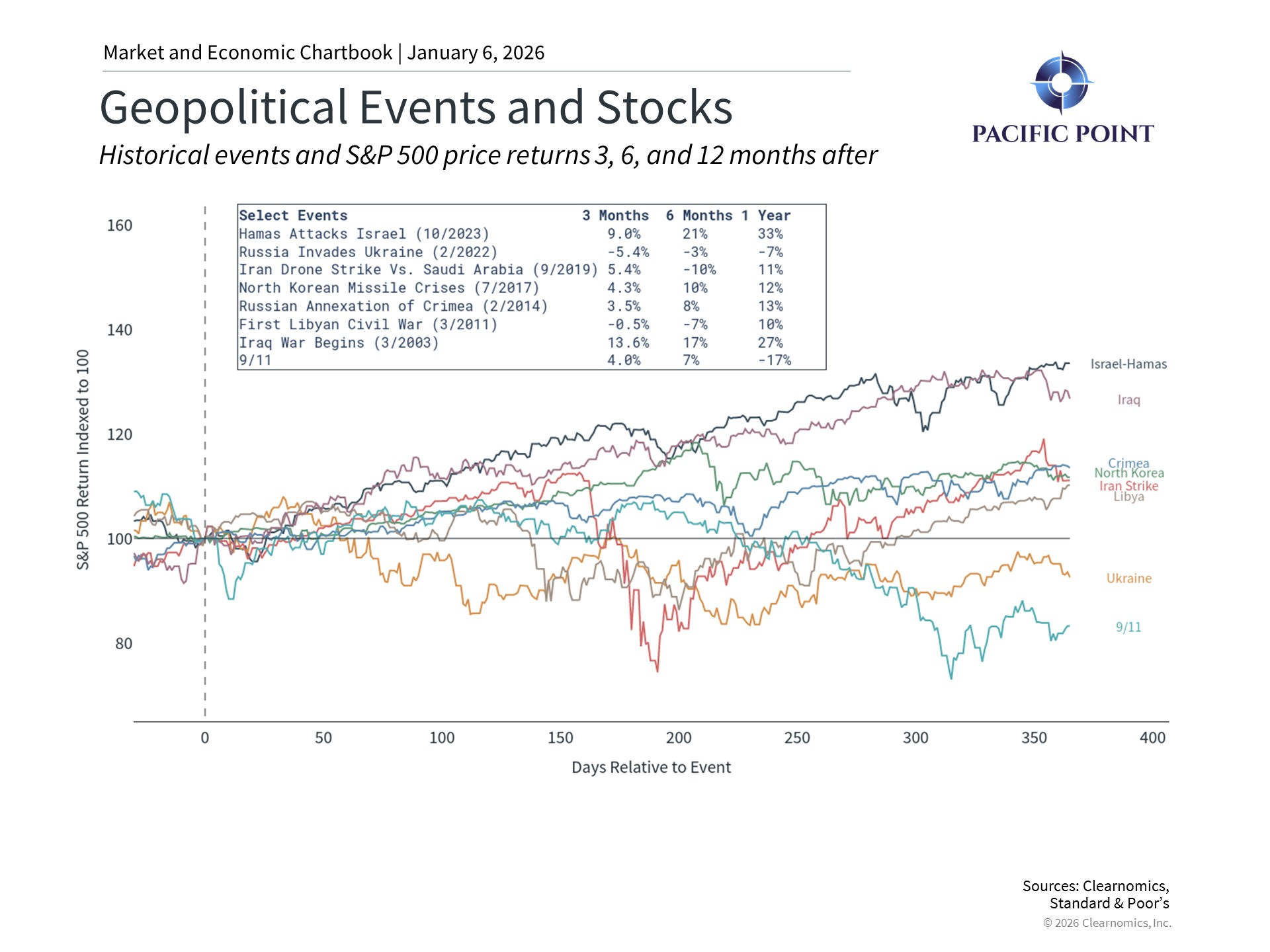

History suggests that geopolitical shocks often create short-term volatility, but they rarely change the long-term direction of markets. As shown in the chart below, U.S. equities have historically delivered positive returns in the months and year following many major geopolitical events—even when the initial headlines felt destabilizing.

From an investment perspective, the main channel through which this situation could matter is oil. Venezuela holds the world’s largest proven reserves, but years of mismanagement have kept production well below potential. Any expansion in supply would likely put downward pressure on oil prices over time—very different from supply disruptions like Russia’s 2022 invasion of Ukraine.

Venezuela itself plays almost no direct role in global financial markets. Its stock market is small, not included in major indices, and the country has been in default on its bonds since 2017. Any impact would be indirect, primarily through energy prices or short-term sentiment.

Geopolitical risk is a constant in investing. Diversification, discipline, and a long-term perspective remain the most reliable responses to uncertainty.