• The September jobs report was delayed more than six weeks due to the government shutdown. The October report will not be released because surveys were incomplete, adding uncertainty for investors and economists. Some October data will instead be published in December.

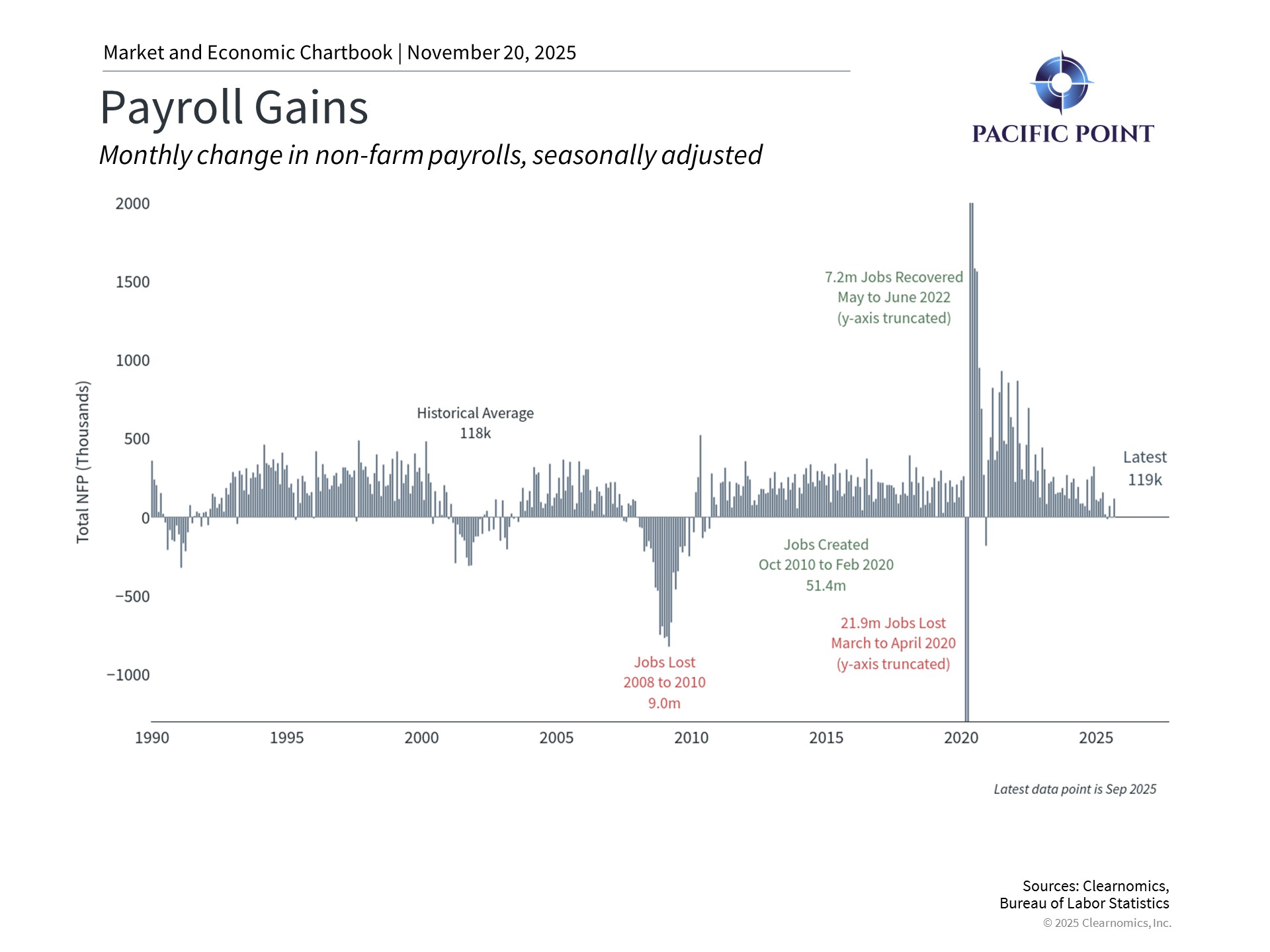

• September payrolls rose 119,000, beating expectations of 51,000 and improving sharply from August. The unemployment rate held steady at 4.4%, up slightly from 4.3%.

• Wage growth remained moderate, with average hourly earnings up 3.8% over the past year, indicating steady but contained labor-market inflation.

• August payrolls were revised down from 22,000 to -4,000, showing a small job loss and highlighting ongoing labor-market softness. This is the second negative revision this year.

• The key question now is how this data will influence the Fed’s December 10 rate decision. Before the report, expectations were already leaning toward no rate change until at least January. The stronger-than-expected numbers reduce pressure for an immediate rate cut.

• The chart below highlights recent payroll volatility. While individual monthly reports can create short-term market reactions, long-term investors are better served by focusing on broader employment trends and maintaining a diversified strategy.