For nearly nine decades, Social Security has served as a cornerstone of retirement security for millions of Americans. However, as demographic shifts and financial pressures mount, questions about the program’s long-term viability have become increasingly prominent. Understanding how Social Security integrates with your broader financial strategy is essential for building a robust retirement plan in today’s uncertain landscape.

Regardless of whether retirement is imminent or still years away, developing a comprehensive understanding of Social Security’s role in your financial future is crucial. By examining the program’s foundation, current obstacles, and available planning approaches, you can make more informed decisions about your retirement preparation.

Understanding Social Security's origins and evolution

Created in 1935 as part of President Franklin D. Roosevelt’s New Deal response to the Great Depression, Social Security began as a modest safety net for aging Americans. The program has since expanded dramatically, becoming a vital source of income for retirees, disabled individuals, and their dependents across the nation. For many Americans today, Social Security benefits constitute a substantial portion of their retirement income.

The program’s fundamental structure presents its primary challenge. Social Security functions on a pay-as-you-go basis, where current workers’ payroll contributions fund today’s beneficiaries. Rather than building individual accounts, your past contributions supported

previous retirees, just as future workers will fund your benefits.

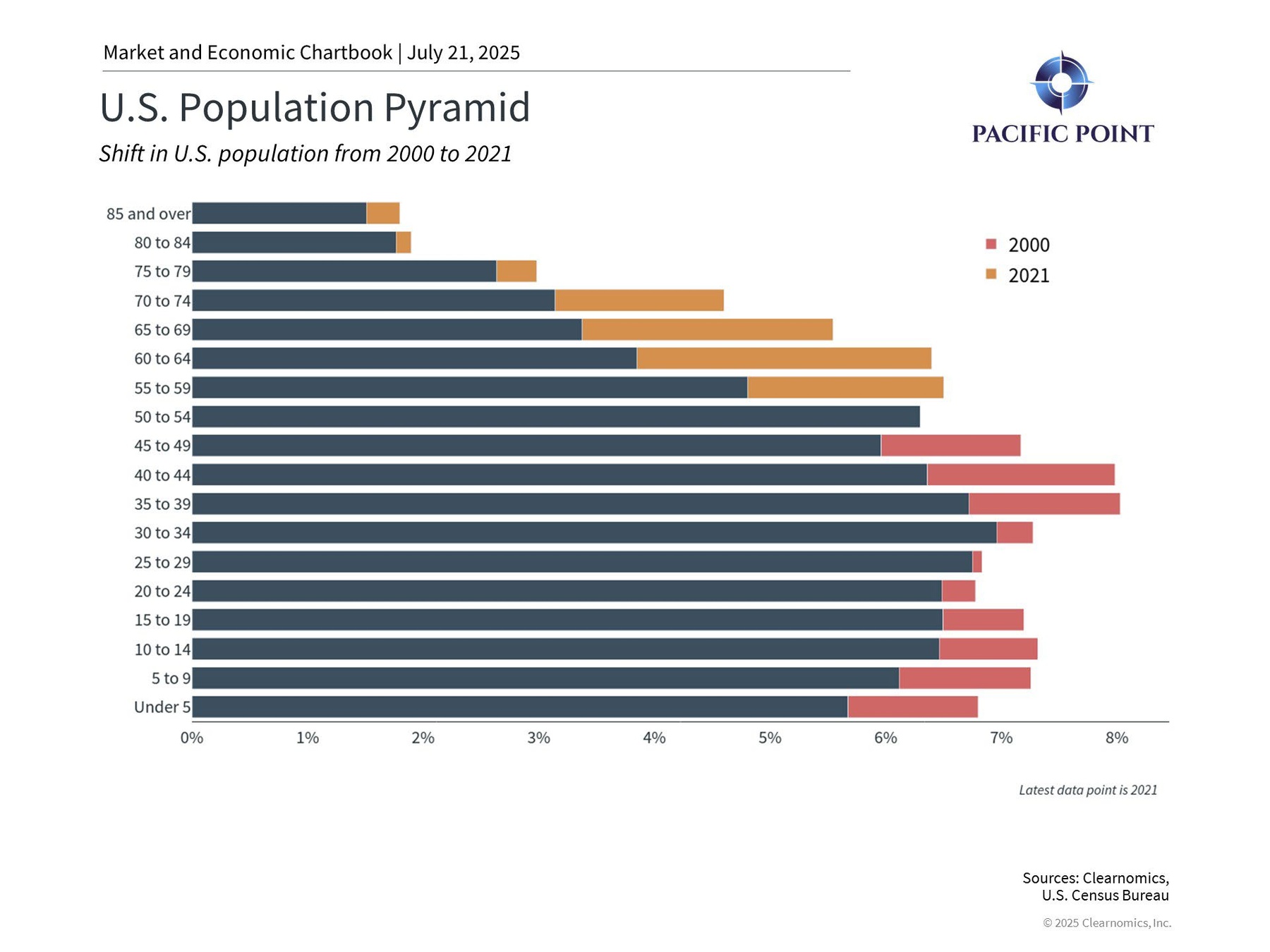

This arrangement functioned effectively when worker-to-retiree ratios were favorable throughout most of the 20th century. However, shifting demographics have created strain on the system. The ratio has dropped dramatically from 42 workers per retiree in 1940 to approximately 2.8 workers per beneficiary today. This trend is expected to continue as the population ages and birth rates remain low.

According to the Social Security Board of Trustees’ most recent projections, the trust funds will maintain adequate reserves through 2034. Beyond that point, incoming payroll taxes alone would cover roughly 78% of scheduled benefits without intervention. While these timelines may fluctuate, the fundamental challenge persists: maintaining full benefit payments indefinitely requires significant reforms.

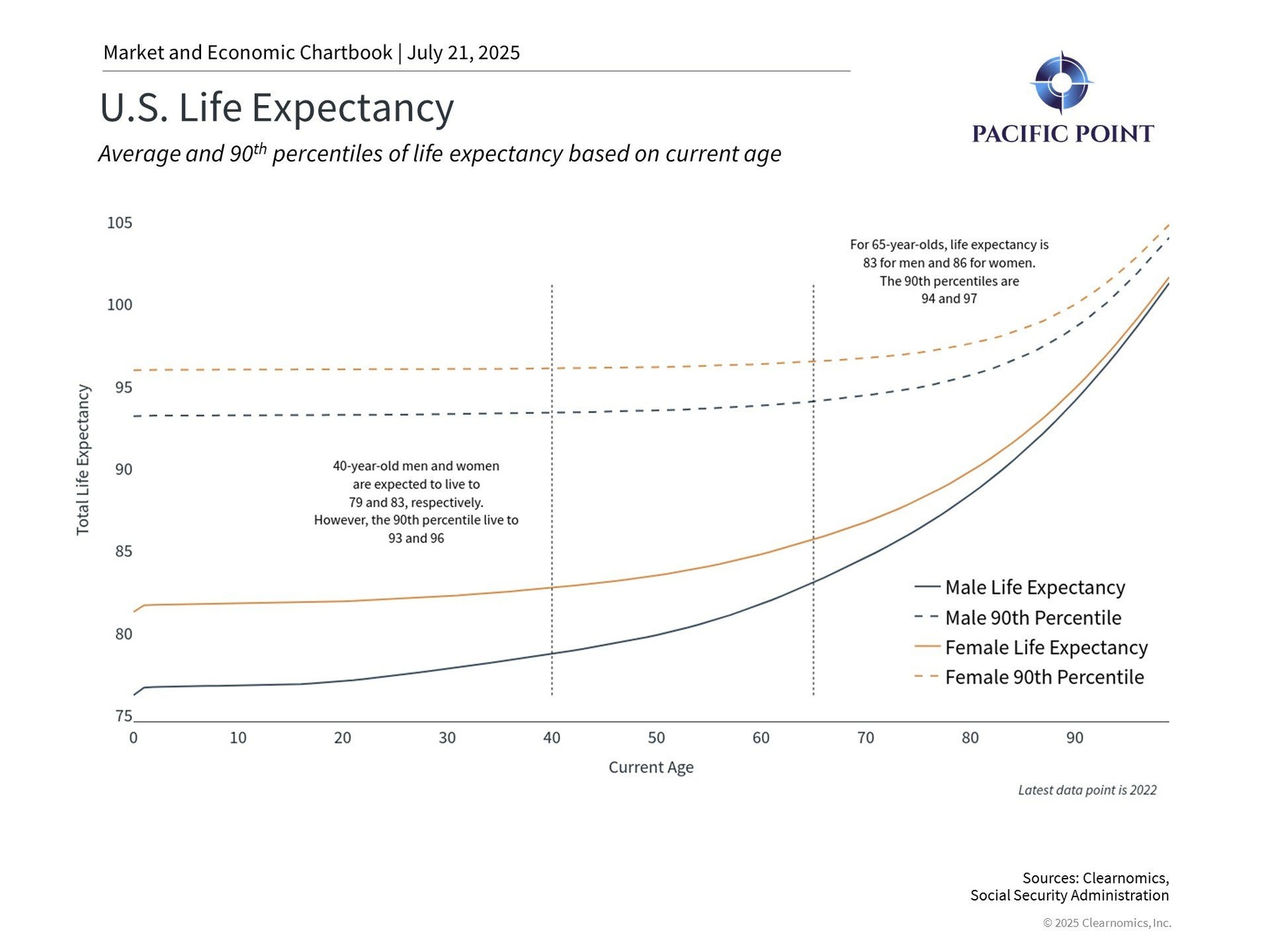

Increased longevity creates sustainability challenges for Social Security

The nation’s fiscal situation adds another layer of complexity, with national debt approaching $37 trillion and ongoing budget deficits. Although Social Security is classified as mandatory spending, mounting pressure to reduce government expenditures creates additional uncertainty about potential program modifications.

Political disagreements over potential solutions make immediate reforms unlikely. Various proposals have emerged, including adjusting retirement ages, modifying the taxable wage ceiling, and improving fraud prevention. However, comprehensive long-term solutions remain elusive.

International examples provide insight into possible approaches. Several European nations, including France and the UK, have raised retirement ages to address similar demographic pressures. Australia has implemented a means-tested system that provides benefits only to retirees meeting specific asset and income criteria.

Although the 2034 timeline remains nearly a decade away, the urgency for solutions will intensify. While complete benefit elimination seems highly improbable, ongoing funding challenges will likely necessitate program adjustments.

Planning Strategies for Retirement Success

Given Social Security’s uncertain future, thoughtful retirement planning becomes even more critical. The optimal approach depends on your complete financial picture, objectives, tax situation, and other personal factors.

Consider these key planning elements:

Timing Your Benefits

While you can begin receiving benefits at age 62, early claiming reduces monthly payments. Alternatively, postponing benefits until age 70 increases monthly payments by roughly 8% annually beyond full retirement age (between 66-67, based on birth year), according to the Social Security Administration.

Breakeven calculations can help evaluate whether delaying benefits makes sense. Typically, if you live past your early 80s, postponing benefits yields higher lifetime payments. However, this analysis may change when considering time value of money or alternative investment opportunities.

Income Bridge Planning

The effectiveness of delaying benefits depends significantly on your interim income sources. Some retirees utilize portfolio distributions as a temporary income bridge while maximizing future Social Security payments. This approach can be especially beneficial for married couples, where optimizing the higher earner’s benefit creates enhanced survivor protection.

Tax Planning Considerations

Social Security benefits may be subject to taxation on up to 85% of payments, based on your combined income levels. Future legislative changes could potentially modify this taxation structure. Strategic withdrawal planning with professional guidance can help minimize the tax burden on your benefits.

Prudent Planning Assumptions

Those with longer time horizons until retirement have greater flexibility to adapt to Social Security uncertainty and more opportunities to adjust their strategies.

Therefore, younger professionals might consider developing retirement plans that don’t depend heavily on Social Security. This approach doesn’t mean disregarding the program completely, but rather viewing potential benefits as supplemental to personal savings rather than foundational support

Monitor Legislative Developments

Policy modifications will likely emerge before trust fund depletion occurs. Staying current on proposed changes enables you to adapt your planning strategy accordingly. Potential adjustments might include further retirement age increases, benefit formula modifications, or payroll tax cap changes.

Optimize Tax-Advantaged Savings

Given Social Security’s uncertain outlook, maximizing contributions to 401(k)s, IRAs, and HSAs becomes increasingly valuable. These vehicles offer tax benefits that can help offset potentially diminished government benefits.

Building Resilient Retirement Plans Around Social Security Uncertainty

While concerns about Social Security’s future are valid, maintaining proper perspective is essential. The program has navigated funding challenges previously, and political incentives to preserve it remain substantial.

The most sensible approach avoids both unrealistic optimism and complete dismissal of Social Security’s retirement planning role. Instead, investors should acknowledge the program’s significance while incorporating it as just one element of a well- diversified retirement approach.

The bottom line? Understanding Social Security's challenges enables you to construct a more durable retirement plan, regardless of where you are in your career journey.

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.