With artificial intelligence dominating headlines and driving the stock market to new highs, many investors are asking whether we’re in another bubble like the dot-com era. It’s a fair concern given today’s high valuations and massive AI-related spending.

Major companies are investing trillions in AI infrastructure—building data centers, purchasing GPUs, and hiring talent. Some deals even appear circular, such as Nvidia investing in OpenAI, which in turn buys Nvidia’s chips. These dynamics raise valid questions about sustainability if enthusiasm fades.

AI’s demand for infrastructure is enormous, but whether the returns will match the investment remains to be seen. For now, AI spending is a significant driver of economic growth. Distinguishing healthy expansion from a bubble is difficult in real time—what matters is whether the technology delivers long-term value.

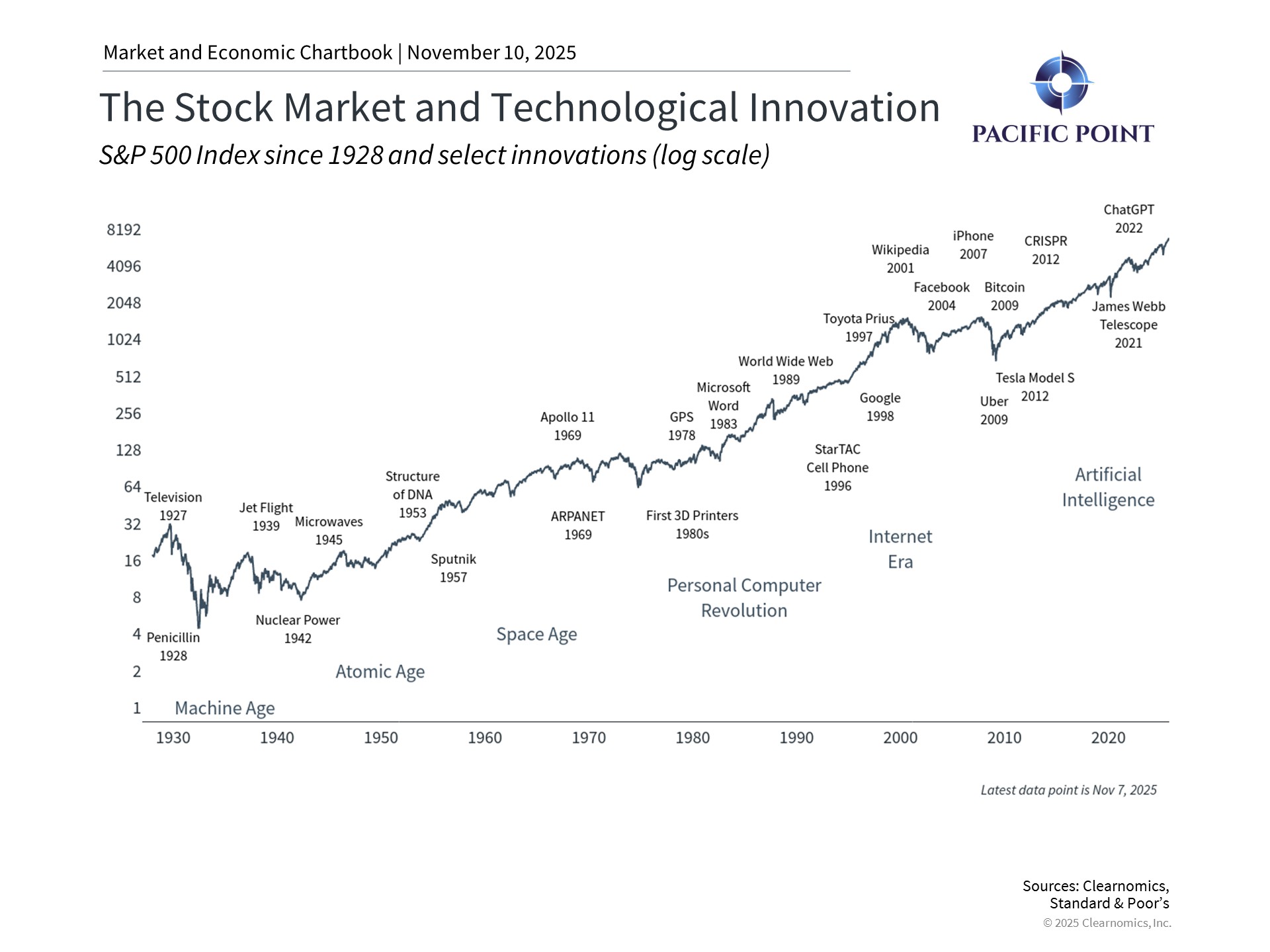

Importantly, today’s AI leaders are established, profitable companies with strong balance sheets. While markets may experience volatility, history shows that transformative innovations—like the internet, electrification, and railroads—often endure beyond early investment cycles.

AI is a genuine technological revolution, but progress and returns may take longer than current enthusiasm implies. Rather than trying to time the market, we focus on maintaining a long-term perspective—positioning your portfolio to participate in innovation while managing risk along the way.