What is The Great Wealth Transfer?

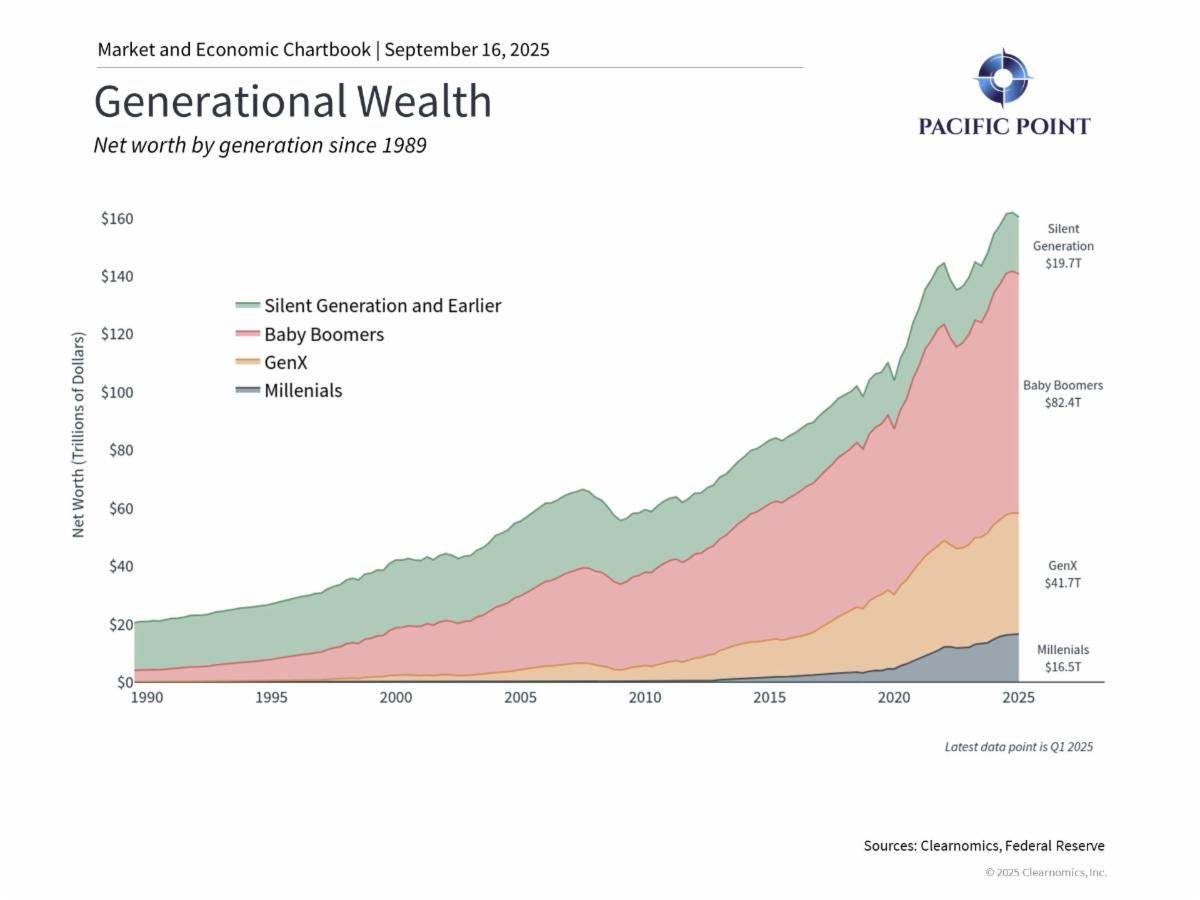

The Great Wealth Transfer refers to the expected shift of $84 trillion from the Silent Generation and Baby Boomers to younger generations over the next two decades, marking one of the largest wealth shifts in modern history.

Key points to consider:

Scale and complexity: Baby Boomers hold over $82 trillion in wealth, much of it in diversified portfolios, multiple retirement accounts, and tax-advantaged savings—far more complex than past inheritances.

Structural changes: Longer lifespans, strong market growth, and the shift from pensions to individual retirement accounts (401(k)s, IRAs) have created more sophisticated wealth structures that require careful management.

Planning challenges: Many issues arise not from lack of assets but from complex investments, unclear estate plans, or unprepared heirs, emphasizing the need for financial education and succession planning.

The chart above illustrates generational wealth distribution, highlighting the scale of assets that will eventually pass to younger generations and their potential impact on markets. Although timing and effects are uncertain, focusing on long-term planning and diversified investment strategies will be key to navigating this generational shift.