Introduction

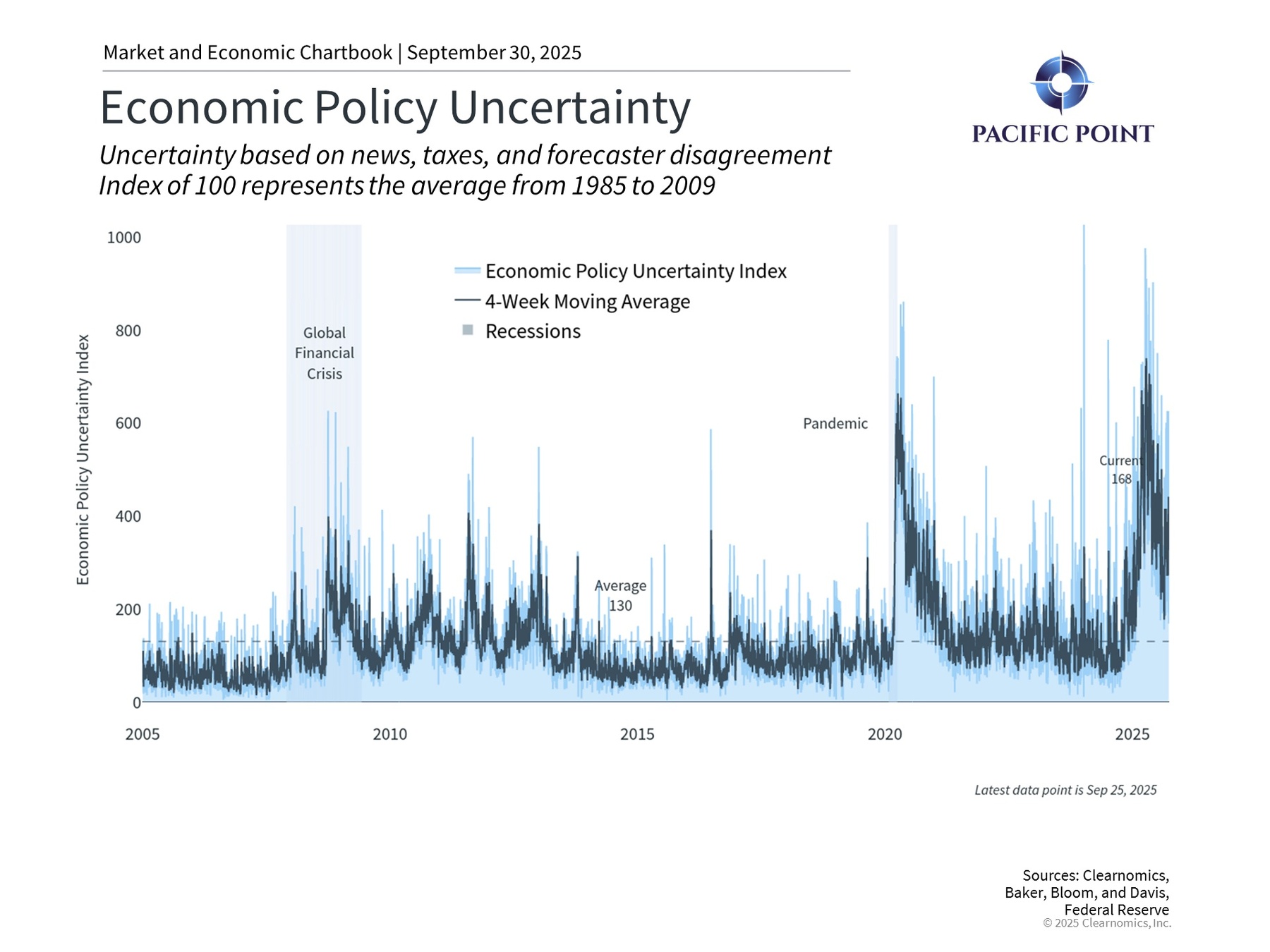

Federal funding battles have returned to center stage in Washington as lawmakers work to avoid a government shutdown. This development comes during a year marked by policy debates over trade, taxation, immigration, and other economic matters that have generated considerable market uncertainty.

Many investors naturally question how political developments might influence their investment portfolios, particularly those tracking fiscal concerns like budget deficits and national debt levels. Examining historical data and understanding why markets typically maintain stability through these events can help investors keep a balanced perspective when political negotiations stall.

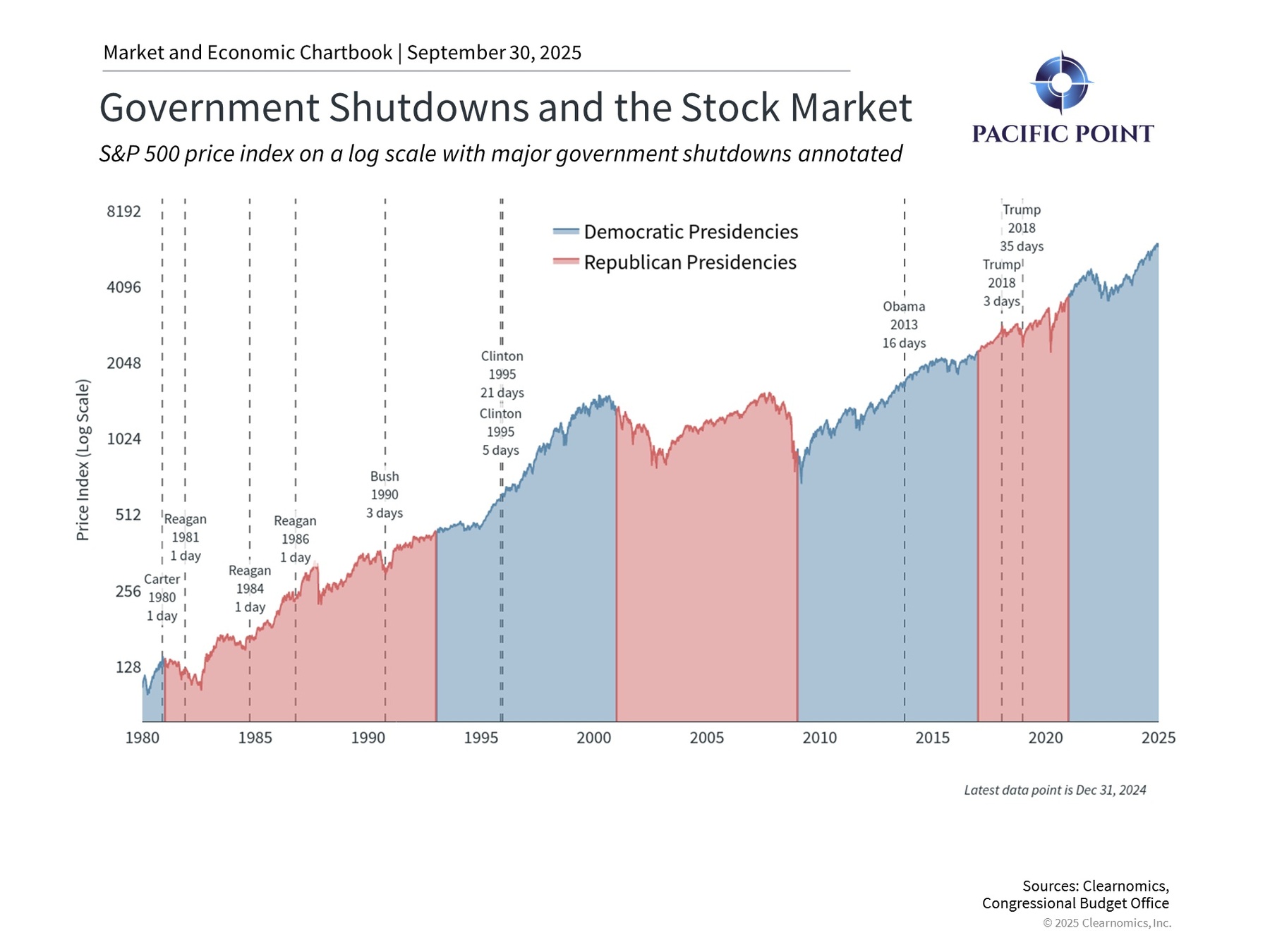

Political tensions in the nation’s capital often generate uncertainty, yet historical evidence demonstrates that funding lapses have consistently shown minimal influence on market performance. Though these shutdowns can significantly impact government employees, their effects on financial markets have been remarkably limited over time. For investors with long-term horizons, these situations underscore the importance of keeping political opinions separate from investment strategies—particularly when news coverage emphasizes contentious issues that haven’t historically influenced portfolio performance.

Markets and the economy have shown resilience during past government shutdowns

Each year, the federal government requires a budget for the upcoming fiscal year starting October 1. Though the “One Big Beautiful Bill Act” passed earlier this year established tax and spending frameworks, actual dollar allocations to departments and agencies require a separate budget. Missing this deadline could trigger a shutdown, pausing government services and placing employees on furlough.

Congress rarely meets budget deadlines—an unsurprising pattern given Washington’s increasingly divided political landscape where finding common ground has grown more challenging. Across nearly five decades, lawmakers have successfully passed appropriations on schedule just a handful of times, establishing last-minute bargaining as standard practice. A frequent workaround involves “continuing resolutions” that provide temporary funding during negotiations. Currently, Republicans are advancing a seven-week temporary funding measure for this purpose.

The chart demonstrates that funding lapses have been recurring events since 1980 across administrations from both parties, yet they’ve produced minimal lasting market consequences. This pattern held even during particularly contentious episodes, including those under Reagan, Clinton’s 21-day lapse in 1995, Obama’s 16-day disruption in 2013, and Trump’s record 35-day shutdown spanning late 2018 to early 2019. From an investment perspective, these events have functioned as brief interruptions rather than serious economic threats.

Budget standoffs reveal fundamental policy disagreements

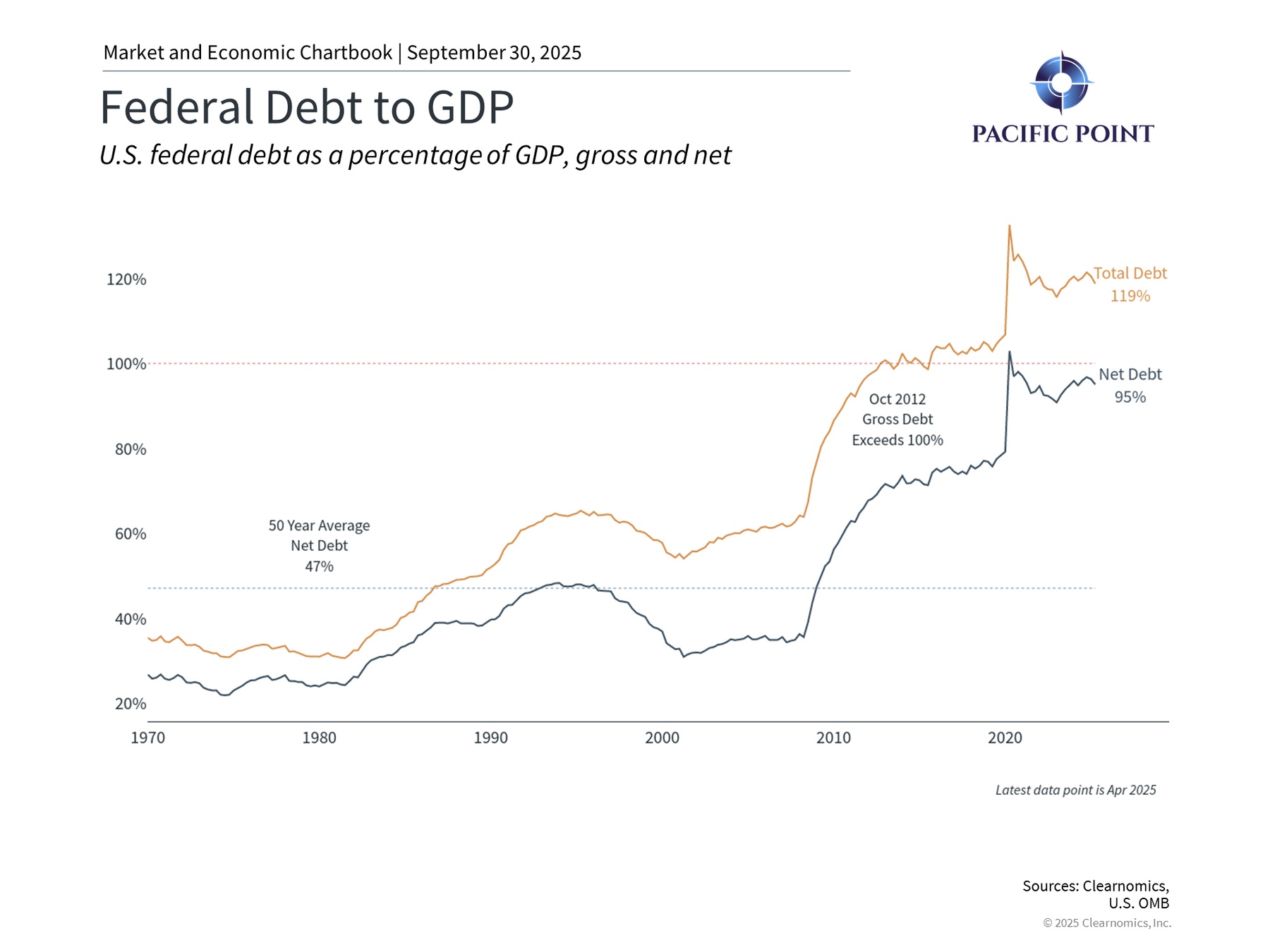

The present circumstances stem from I’m disputes over spending priorities, with healthcare at the forefront. Though immediate government funding remains the central issue, these budget confrontations expose fundamental divisions regarding government’s proper scope and fiscal responsibility. With federal debt hovering around 120% of GDP, widespread agreement exists on the necessity of fiscal restraint, yet sharp disagreement persists over implementation methods.

This scenario stands apart from previous instances due to administrative directives requiring agencies to develop permanent workforce reduction strategies beyond standard temporary furloughs. This marks a shift from historical shutdown patterns and may produce more enduring effects on employment and government spending. Note that furloughed federal employees automatically receive retroactive Powered by Clearnomics 2compensation once operations resume, a provision established during the 2018-2019 shutdown resolution.

Some investors may conflate shutdown threats with other fiscal matters like the debt ceiling. Debt ceiling issues arise when previously approved spending requires payment but the Treasury Department lacks authorization to borrow beyond statutory limits. The sole remedy involves congressional action to raise borrowing authority, or else the government faces default risk. These fiscal challenges contributed to major credit rating agencies downgrading U.S. debt below AAA status. Fortunately, the One Big Beautiful Bill Act increased the debt ceiling by $5 trillion, postponing this concern for the foreseeable future.

Financial markets prioritize economic fundamentals over political developments

Despite investor concerns about the nation’s fiscal direction, funding lapses have proven largely inconsequential for market performance. The explanation is clear: these disruptions are temporary and don’t alter fundamental economic conditions.

Data reporting can face interruptions during shutdowns, potentially affecting crucial information like the Bureau of Labor Statistics’ employment reports and Consumer Price Index. However, this typically only postpones releases, with normal reporting resuming after operations restart. Extended shutdowns may create modest economic headwinds as federal employees postpone purchases and government services experience interruptions.

The Economic Policy Uncertainty chart reveals that tariffs and taxes earlier this year posed substantial investor challenges. Yet with recent resolution on both fronts, this measure has declined toward its historical average. While shutdowns could potentially increase uncertainty, historical evidence indicates that even prolonged government disruptions have generally left investors unaffected.

The bottom line? While government shutdowns capture headlines, affect federal workers, and interrupt essential services, their historical impact on financial markets has been negligible. Investors benefit most from maintaining focus on their long-term financial strategies rather than reacting to Washington’s daily developments.

Clearnomics Disclaimer

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.